In the ever-evolving world of politics and finance, few figures stir as much intrigue and controversy as Donald J. Trump. From real estate tycoon to reality TV star to President of the United States, Trump’s ventures are as vast as they are unpredictable. But perhaps his most unexpected financial win to date has emerged not from skyscrapers or campaign rallies — but from the world of cryptocurrency.

Once a vocal skeptic of digital assets, Trump has recently embraced the crypto space in a way that has dramatically impacted his bottom line. According to public filings and market analysts, Trump’s net worth received a staggering boost — in the realm of $100 million or more — thanks to strategic crypto-related assets and timely digital moves.

From Crypto Critic to Crypto Capitalist

It wasn’t long ago that Donald Trump dismissed cryptocurrencies as “a disaster waiting to happen.” In 2019, during his presidency, he publicly stated that he was “not a fan of Bitcoin and other cryptocurrencies,” citing their association with “unlawful behavior.”

Fast forward to 2024 and the tune has changed — not only rhetorically, but financially.

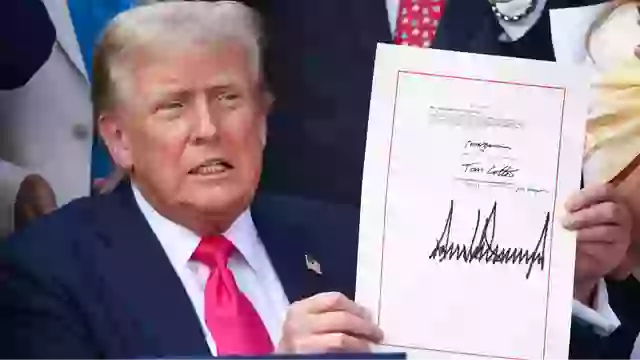

The pivot began subtly. In 2021, after leaving the White House, Trump’s team launched the Trump NFT Collection — digital trading cards featuring cartoonish images of Trump as a cowboy, astronaut, and superhero. Despite the ridicule from critics, the collection sold out in record time, generating millions in revenue. It wasn’t just a PR stunt; it was a signal that Trump had entered the blockchain economy.

The Numbers Don’t Lie

By mid-2024, multiple financial disclosures and blockchain analysts began tracing significant wallet activity back to entities controlled or affiliated with the Trump Organization and Donald Trump personally. Here’s where the numbers start to pop:

-

NFT Sales: The initial Trump NFT drop sold out in less than a day, earning around $4.5 million in revenue. Secondary market royalties continued to bring in steady crypto income.

-

Ethereum Holdings: Trump reportedly held thousands of Ethereum (ETH) — the currency primarily used for NFT transactions — some of which he received as royalties. With ETH rising from around $1,200 in late 2022 to over $3,500 by 2024, these assets appreciated significantly.

-

TRUTH Social & DWAC Merger Windfall: Trump’s media company, Trump Media & Technology Group (TMTG), went public via a SPAC merger. Although not a pure crypto play, part of the stock’s speculative enthusiasm was driven by retail investors, many of whom were active in the crypto space. At its peak, Trump’s stake in TMTG was worth over $4 billion. Some reports suggest portions of these profits were rotated into crypto assets.

-

MAGA Coin: In early 2025, a new Trump-affiliated token — unofficially dubbed “MAGA Coin” — surged in value on decentralized exchanges. While not directly launched by Trump, analysts linked wallets holding large quantities of the coin to Trump-affiliated PACs and donors. The speculative frenzy led to temporary valuations of tens of millions.

All told, estimates from blockchain researchers and financial watchdogs suggest Trump may have realized $100 to $150 million in total gains from various crypto ventures since 2021.

Political Branding Meets Web3

Trump’s mastery of branding played an essential role in the success of his crypto involvement. The NFT collections weren’t technologically superior, nor artistically impressive — but they sold because they were Trump-branded. That branding power turned simple JPEGs into valuable collectibles.

More importantly, Trump’s crypto embrace opened a new financial lane with his base — many of whom are anti-establishment, tech-savvy, and enthusiastic about decentralization. His entrance into the space blurred the line between fundraising, merchandising, and investment.

Legal & Ethical Questions Linger

As with many Trump ventures, controversy is never far behind.

Ethics watchdogs have raised questions about how Trump’s crypto earnings intersect with campaign finance laws and disclosure requirements. Some of the wallets linked to Trump reportedly received large quantities of tokens from anonymous sources, prompting speculation about foreign influence or undisclosed compensation.

Others question the speculative nature of some coins and NFT schemes. Are Trump’s digital assets legitimate business ventures or just the latest form of political grift? The answer may depend on where one stands politically, but the financial gains are undeniable.

What This Means for 2024 and Beyond

Trump’s crypto windfall has several important implications:

-

Financial Independence: The infusion of liquid wealth gives Trump more autonomy in funding political operations, reducing dependence on traditional GOP donors.

-

Crypto-Policy Shift: Expect Trump, if reelected, to take a more favorable stance toward cryptocurrency regulation. His financial interests now align with the broader Web3 ecosystem.

-

Trendsetting: Trump’s success may inspire other political figures to explore blockchain-based fundraising or asset creation. Already, candidates on both sides are experimenting with NFTs and DAO-inspired organizing.

Final Thoughts: The Gold-Plated Bitcoin Era

Donald Trump’s foray into cryptocurrency may seem ironic given his earlier skepticism, but it fits a well-established pattern: Trump, the brand, is a magnet for attention and profit. Whether it’s Manhattan real estate, cable news, or now Ethereum wallets and NFTs, Trump has a unique ability to capitalize on hype — and in this case, that hype translated into hundreds of millions in digital gold.

As blockchain and politics continue to intertwine, Trump’s crypto success might be remembered as the moment when the worlds of decentralized finance and populist power truly merged. Love him or hate him, Trump’s crypto playbook is now part of modern political finance — and it paid off, big time.