When former President Donald Trump unveiled his new automotive tariff exemption in 2025, the intent was clear: revive American manufacturing, penalize offshoring, and encourage automakers to “build in the USA.” However, despite the sweeping rhetoric, one company seems to be uniquely positioned to benefit: Tesla.

While legacy automakers scramble to restructure their supply chains to avoid steep import duties, Tesla finds itself in the rare position of being largely unaffected—or even advantaged—by the rules of the exemption. But why Tesla, and why now?

The Policy: A Quick Breakdown

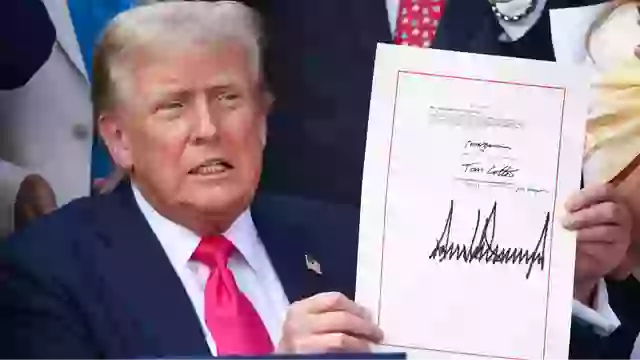

Trump’s policy, reinstated in March 2025, imposes a 25% tariff on all imported vehicles and vehicle parts. However, a key loophole was added: vehicles with 85% or more U.S.-made content are exempt from the tariff. This was pitched as a reward for companies that manufacture and source domestically.

At first glance, this policy should benefit any American automaker. But the devil, as always, is in the details.

Tesla’s Vertical Integration Advantage

Tesla’s production model is significantly different from its competitors. While Ford, General Motors, and Stellantis operate with traditional supply chains—spanning Mexico, Canada, Europe, and Asia—Tesla’s core strength lies in vertical integration.

Most of Tesla’s vehicle production takes place in the United States, primarily in Fremont, California, and at Giga Texas in Austin. Tesla also manufactures batteries domestically, through a partnership with Panasonic at its Nevada Gigafactory. This structure means Tesla’s most popular models—Model 3 and Model Y—already meet or exceed the 85% domestic content threshold required by the tariff exemption.

While competitors outsource engines, drivetrains, software, and even final assembly abroad, Tesla does the opposite. Its software is written in-house. Its AI chips are designed by its own teams. It even manufactures seats internally—a rarity in the industry.

That obsessive control over its manufacturing pipeline is now paying dividends.

A Sudden Disadvantage for Legacy Automakers

Ford’s Mustang Mach-E, built in Mexico. GM’s Bolt EUV, which relies heavily on South Korean battery components. Toyota’s best-selling RAV4, largely assembled in Canada and Japan. These vehicles, along with dozens of other models, now face a pricing dilemma.

Either:

-

Their manufacturers eat the 25% tariff cost, crushing profit margins.

-

They pass the cost onto consumers, making their vehicles less competitive.

Tesla, by contrast, avoids these headaches entirely—at least on its highest-volume vehicles. For example, a Model Y built in Austin sails through the new exemption criteria. That means it can maintain price stability while competitors are forced to raise prices or curtail production.

A Subtle Tilt: Not Just “America First” — “Tesla First”?

Critics have pointed out that the tariff’s 85% domestic content requirement is a steep threshold. Most vehicles sold in the U.S. have nowhere near that level of American content. According to the American Automobile Labeling Act (AALA), only a handful of vehicles exceed the 75% mark—and Tesla’s are among them.

Some analysts speculate the exemption may not just be about promoting American jobs—it may also reflect the Trump administration’s historically favorable stance toward Elon Musk. After all, Trump and Musk have maintained an on-again, off-again relationship of mutual admiration and strategic alignment. While Musk has occasionally clashed with political figures, he’s also voiced support for deregulation and domestic manufacturing—ideals Trump claims to champion.

Whether intentional or not, the policy’s parameters function almost as if they were tailor-made for Tesla.

Tesla’s Weak Spot: Imported Parts Still Matter

While Tesla has a head start, it’s not completely immune to the consequences of the new tariffs. Around 20% of its components—particularly some electronics and battery minerals—are still sourced abroad. This includes parts from China, a country specifically targeted by Trump’s broader trade war strategy.

In fact, Musk himself recently acknowledged the issue in a public post on X, calling the tariffs “a mixed bag” and noting that imported costs remain “non-trivial.” The irony is that, despite Tesla’s advantage over competitors, it will still suffer cost pressure on specific vehicle models and updates.

But overall, Tesla is far better positioned than its rivals to absorb or avoid these shocks.

The Bigger Picture: Market Dynamics Shift

The market has already responded. Following the announcement, Tesla’s share of U.S. EV sales jumped slightly, while Ford and GM stocks dipped on fears of reduced margins. Industry analysts predict a short-term reshuffle of consumer preferences, particularly in the EV sector, where Tesla’s price positioning is suddenly more attractive.

Consider this: A foreign-made EV now faces 25% in added costs, while a Tesla Model Y—already eligible for federal EV tax credits and tariff exemption—becomes not just patriotic, but also economically logical.

In other words, the “buy American” message just got a new face: Elon Musk.

Conclusion: A Perfect Storm of Policy and Strategy

Trump’s automotive tariff exemption wasn’t overtly designed to benefit Tesla—but it does. Through a combination of vertical integration, U.S.-based production, and fortuitous timing, Tesla is the standout winner in an industry-wide upheaval.

While other automakers will need months—or years—to reconfigure supply chains to avoid the tariff burden, Tesla is already there. And for Elon Musk, it’s yet another example of his company turning disruption into dominance.

As the auto industry scrambles to catch up, one thing is clear: Tesla didn’t just dodge the tariff bullet—it may be the only one driving away from it.